It’s widely accepted that surveys are a great way to do market research, gauge customer loyalty, and make better decisions in your business.

Most of the time, people focus on the type of survey they’re using but spend much less effort on the questions. In reality, survey questions are the most important aspect of the questionnaire.

They affect the quality of the data you collect.

This guide breaks down the types of survey questions, best practices, and multiple examples. By the end, you’ll know when and how to ask questions to grow your business.

What is a survey question?

This is the wrong question because the answer is apparent. It’s any question you ask a survey respondent.

The better question is “What’s a good survey question?”

Good survey questions aid respondent comprehension and allow you to get clear actionable feedback and business insights about your customers. It’ll allow you to:

- Determine the best products for the market

- Find the right price point

- Get a deeper understanding of psychographic, demographic, or firmographic information

- Gauge customer loyalty

- Understand problems with your messaging

- Optimize your website as a whole

- Etc.

A survey can do a lot but it’s also easy to get it wrong.

Why you should spend time getting survey questions right

Survey data can impact almost every aspect of your business because it’s a form of zero party data. That is, information your customers or audience members want you to have that was collected directly from them.

In a business context, zero party data is the gold standard. Tools, third party data providers, and even Facebook may not be able to give you those insights.

Zero party data is only effective if you spend the time to collect it the right way.

For example, if you ask a confusing question, you may get an answer but it may not be what they’d have otherwise answered. Or, you may accidentally ask a leading question and skew the results in favor of or against what you’re asking.

In either case, you’re not getting the real data you need to improve your business. The decisions you make are wrong at best and detrimental at worst. You’ll get a rundown of survey question best practices at the end of this guide. First, let’s look at the types of survey questions.

Types of survey questions

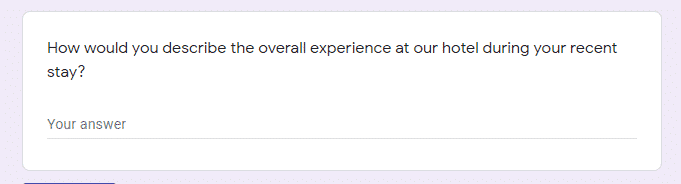

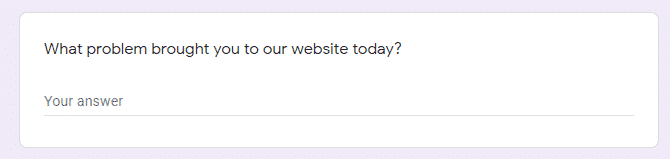

Open-ended questions

Open-ended questions are unstructured survey questions that allow respondents to reply in an open text format. The key is that they don’t have preset answer choices.

You get more detailed answers and the ability to collect the voice of customer data to use in marketing, product development, and acquisition. There are many types of open-ended questions but the most common are short answer and long answer questions.

Examples of this type of question include:

- What should we do to make this page clearer?

- How would you describe your customer support experience today?

- If we could change one thing in our business, what would you like that to be?

When to use open-ended questions

Open-ended questions have a wide range of applications such as:

- When you’re doing initial product research and only have a vague idea of what people in the market expect, are already using, or would like to accomplish with the product. Open-ended questions allow people to give you a lot of information to guide your decisions.

- They’re also useful for customer feedback when you don’t have any benchmark data. For example, if today is the first time you’re surveying customers you may not know their niche, demographics, wants, needs, etc. so you may not be able to create clear closed-ended question answer options.

Keep in mind that open-ended questions cannot be used in all situations. There are a few disadvantages. People are more likely to skip open-ended questions because they take more effort to answer.

Another disadvantage is that your survey software cannot analyze data from open-ended questions automatically. When you have many respondents, the entire process can be time-consuming.

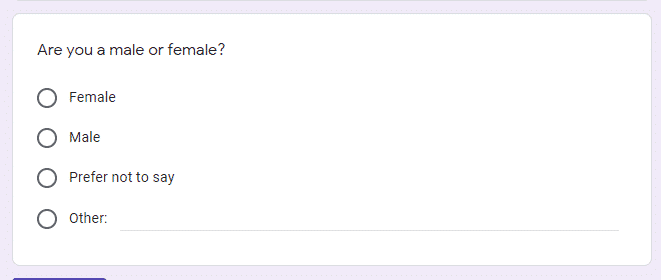

Closed ended questions

Close ended questions are survey questions that require respondents to choose from a predefined set of answer options. The key to effective close ended questions is understanding the range of possible answer choices to a question.

When crafting these potential responses, it’s crucial to put yourself in your audience’s shoes and think about their real-world situations. The beauty of well-thought-out answer choices is that they make your survey feel more personal and relevant, showing respondents you understand their world.

Most importantly, taking time to map out potential responses beforehand helps you avoid that awkward moment when someone can’t find an option that fits them – and there’s nothing worse than losing valuable feedback because your choices missed the mark.

For example, if you ask your respondents about their company title, you should already have a good idea of potential responses. If KyLeads was to ask, we’d provide options like founder, content marketer, CRO specialist, etc. it wouldn’t make sense for us to provide options like carpenter, driver, welder, etc.

Close ended questions are also multiple-choice, rating scale, and Likert scale questions which we’ll touch on in more detail. Here are a few examples of how they can be worded:

- What is your gender?

- Are you below 35?

- Did you have a good customer service experience?

When to use close ended questions:

- When you want to confirm a hypothesis. You’ve already done initial research about a product, topic, idea, etc. and want to confirm or disprove it. You’d ask a closed ended question to get easy-to-analyze insights. Do you like coke (yes/no)?

- When it’s important to be able to quickly analyze survey results. Open-ended questions take considerable time to analyze. Close ended questions, on the other hand, can be grouped and the data displayed as graphs, charts, etc.

- If you want to ease into a survey. The fastest way to turn people off is to ask a difficult question upfront. Instead, use close ended questions to get people started and allow them to build momentum.

There are many situations when close ended questions aren’t useful or will limit the insights you gain such as:

- When you want to understand the reasons behind an answer. For example, a customer gave you a low rating and you want to know why. A close ended question wouldn’t work well.

- In the initial research stages when a hypothesis is lacking. Close ended questions used here are likely to miss the mark because there’s not enough understanding of the problem to create insightful answer options.

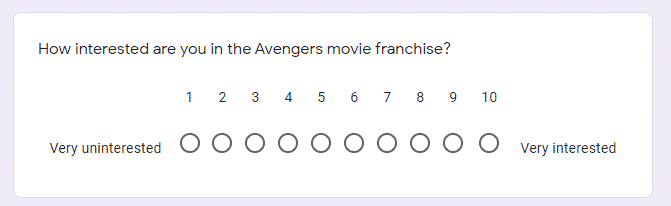

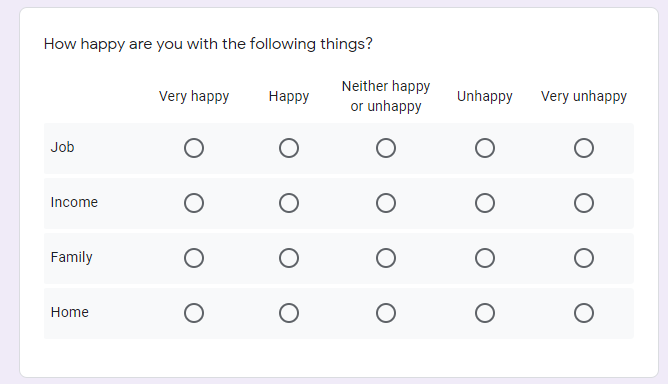

Rating scale questions

Rating scale questions are a type of survey question that requires respondents to use a numeric answer scale to respond. One of the most popular types of rating scale is the NPS survey which asks people to give an answer based on a 10 point scale (How likely are you to recommend our product to a friend or colleague).

Keep in mind that it’s another type of close ended question and the same limitations apply. Examples include:

- On a scale of 1 – 10 how would you rate our customer service today

- On a scale of 1 – 10, how would you rate your satisfaction with our product

When to use rating scale questions

Rating scales have a wide range of applications such as gauging satisfaction, loyalty, and even likelihood to purchase. They allow you to assign a numerical value to answers and get more nuanced than a simple yes/no question.

You can also compare the results from the same survey over time and determine if you’re improving or not. This is especially powerful when tracking Net Promoter Score® or customer satisfaction.

Rating scale questions also provide an easy way to share information about performance between teams – especially if you’re living the laptop lifestyle (AKA remote work) – because they don’t have to work hard to interpret results.

In the realm of surveys, customer satisfaction reigns supreme as the royal decree that shapes the very fabric of your questionnaire kingdom. By infusing each question with the essence of this noble pursuit, you’ll create a tapestry of insights that illuminates the deepest desires and challenges faced by your loyal subjects.

Embark on this quest with customer satisfaction as your guiding light, and watch as your survey transforms from a mere scroll of parchment into a powerful tool that forges unbreakable bonds between you and your audience, revealing the path to experiences that will be heralded throughout the land.

- Customer satisfaction

- Customer loyalty

- Likelihood to perform an action

- When you want to compare results from the same survey over time

Just like with the close-ended question this one stems from, it’s not ideal when you’re still trying to understand the problem or topic.

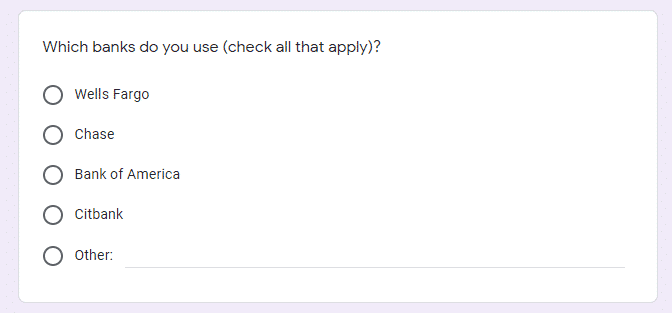

Multiple-choice questions

Multiple choice questions (MCQ) are a type of close ended question where respondents are provided with 2 or more answer choices and can choose one or more. Unlike many other survey questions, an MCQ can have right or wrong answers depending on the context.

Examples include:

- Which of the best options describes your current situation

- How often do you go to the gym

- Which banks do you use (select all that apply)

Oftentimes, MCQ has an “other” option in case the presented answer options don’t apply to the respondent.

When to use multiple-choice questions

- You want to determine the groups in your audience and the relationship between different variables (this is known as cross-tabulation). For example, you know you have CMOs, CEOs, and COOs, in your audience, their gender, and age. Cross-tabulation lets you determine the average age and gender of each of these groups.

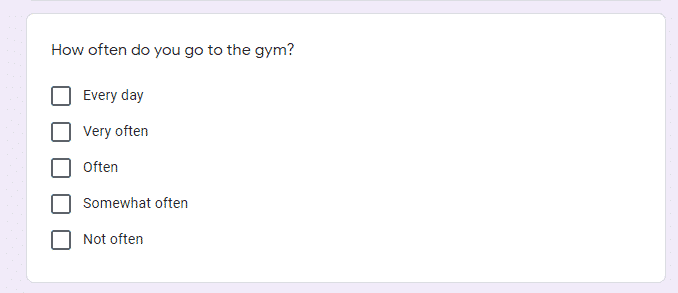

Semantic differential scale survey questions

A semantic differential scale question is a rating scale that uses words instead of numbers. It helps determine the degree of sentiment or frequency of activity. The scale can be based on two polar opposites such as love and hate or from a neutral position to an extreme such as extremely satisfied to unsatisfied.

A popular type of semantic differential scale is the Likert scale which is often used in customer service to gauge an experience. Instead of simply asking if they were happy or not, you can understand exactly how happy they were.

A statement is presented and respondents are asked to choose an option that represents their degree of feeling or frequence.

Example of semantic differential scale survey questions include:

- Exercise is an important part of my morning routine

- Strongly agree

- Agree

- Neither agree nor disagree

- Disagree

- Strongly disagree

- I would recommend this product to my friends

- How satisfied are you with the service provided

When to use semantic differential scale questions

These questions are perfect for understanding your audience’s or customer’s stance on your products and services. These insights can tell you whether you’re on the right track or missing the mark completely.

It can also, to an extent, be used for product research but they have to be phrased correctly. Instead of asking would you wear yoga pants to the gym, you’ll want to know how often they go to the gym or how often they wear a specific type of clothing to the gym.

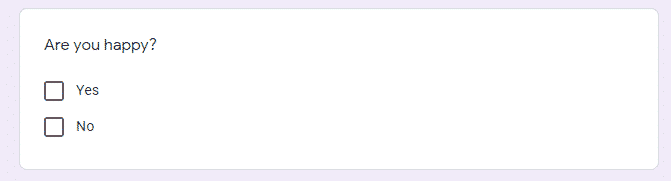

Yes/no questions

Yes/no questions (also known as dichotomous questions and bipolar questions) are simple close ended survey questions that only have two potential answers – yes or no.

These questions are used when the scope of the question is narrow.

- Did you like the food?

- Are you too hot?

When to use Yes/no questions

Yes/no questions are ideal for qualifying prospects, determining if you’re on the right track with an assumption, or even finding out if large number of your current customer base experiences a specific problem.

For example, you may only sell to people who are CEOs so a simple yes or no question could be “are you a CEO?” If they answer no then you know they’re not qualified and can move on to the next prospect.

If you’re doing product research you may ask if the problem you’re solving matters to your customers. If the majority say no it may be a sign that you should go back to the drawing board to revamp the idea or throw it out altogether.

How to create good survey questions

Knowing the type of survey questions available and when to use them doesn’t guarantee they’ll be high quality. Let’s look at a few factors to consider when making your questions to ensure they get you the data you want.

Focus on the needs of customers

Businesses exist to solve problems, not sell a specific product or service. When the product or service stops meeting the needs of the customer, they stop buying. In the same vein, your survey questions should focus on revealing the needs of your customers, not how much they liked your product.

For example, “What’s your favorite feature of the laptop” could be changed to “what specific problem were you looking to solve with the laptop?”

Ask one question at a time

Follow up questions can be a tricky thing because we want to derive as much insight as possible from our surveys. At the same time, we know attention spans are short and people may abandon the survey if it’s too long.

This can tempt survey makers to combine questions. For example, “what specific problem were you looking to solve with the laptop? Were you able to solve it?”

Those are two separate questions asked together. A respondent may choose to answer only one of the questions, mix the responses together, or answer neither. Instead, separate the question into two.

Keep it concise

The longer your question, the more opportunities for it to be misunderstood by your respondent. When it’s misunderstood, you get inaccurate data. Keep the question itself concise but make sure to add any explanatory text or examples so they can get a better idea of what you want.

Don’t lead survey takers

The point of a survey is to get unbiased information that’ll help you improve your business. If you lead people to a certain response then you won’t be able to develop in the places you’re lacking.

The art of surveying customers requires a delicate balance between curiosity and restraint, like a master chef who knows exactly how much seasoning will enhance rather than overpower a dish. When done right, surveying customers becomes less about extracting data and more about initiating a meaningful dialogue that reveals the subtle flavors of customer experience.

It’s about crafting questions that invite honest reflection rather than mechanical responses, creating an environment where respondents feel like valued contributors to your business evolution rather than mere data points. This approach transforms the traditional survey process into a collaborative journey of discovery, where each response adds another brushstroke to the canvas of customer understanding, painting a more vivid picture of what truly matters to your audience.

For example, a survey question could read “We’ve been voted the best tech company in Atlanta 3 years in a row, what do you think of your customer service experience today?”

The respondent is likely to give a more positive answer than they would have if they weren’t biased by the question. Biases can also be negative. Prevent this by paying special attention to your wording and anything that can create a negative or positive connotation.

Ensure questions are clear

This follows on the heels of leading survey-takers to a specific answer. Remove extra text within the question itself and instead add it as microcopy. This prevents explanatory information from being misinterpreted.

Another thing to consider is your word choice. If a simpler version of the word can be used then do so to prevent confusion. Instead of imperative, use important.

Start with easy questions

Most surveys, no matter how much you try, aren’t fun. They’re not like quizzes that have an interactive and reward element. Get more people to start and continue the survey by beginning with easy close ended questions. Work your way up to involved open-ended questions.

Alternate question types

There’s something called the extreme response bias which is when people tend to go for the extremes of rating scales. There’s also the central tendency bias where people go for the middle of rating scales.

Both of them occur when rating scale questions are stacked together or follow each other in close succession. Cut down on these cognitive biases by switching between question types. Use an open-ended question, an MCQ, a rating scale, etc.

Run a survey pilot before you launch it to a large audience

You may think your survey is perfect but you’ll never know until you send it to real people. Instead of sending it to everyone at once, choose a small segment in your database to try it out on.

Look for:

- Answers that are skewed in one direction (for example, too many males when you know your audience is an even split)

- Many questions being skipped

- A long completion time

- Answers that don’t seem to answer the question

Focus on open-ended questions (with caveats)

If you’ve not sent a survey out to an audience about a specific topic or are just now starting the research, use open-ended questions. These give you a deeper understanding of the problems, unlock the voice of customer data, and let you get down into the weeds.

When you come up for air, you’ll have a clear picture of what’s important and what’s not. You can then send out a second survey with close ended questions. The answer options are the insights you’ve gained from using open-ended questions.

If you’re well versed with the niche, product, topics, etc. You can skip the open-ended question part and go straight to close ended questions.

Conclusion

Surveys are an amazing way to get information that would otherwise pass you by. They take more thought and effort than many people realize.

This article has gone through many of the different types of survey questions and when you should use them for maximum impact. Keep the best practices for creating survey questions in mind and you should do well.

Let me know what you think in the comments and don’t forget to share.